There are many ways to make your food company defensibly unique. This can include building an innovative brand that speaks to consumers that weren’t being spoken to before and stands out in its category or categories. This could mean developing a proprietary technology or process that allows you to make truly unique products. This could mean sourcing unique ingredients from a known and understood supply chain.

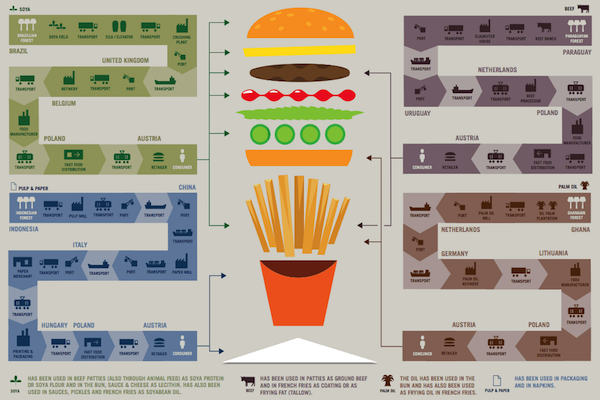

However, what if the supply chain didn’t already exist? Could you build a supply chain that is defensibly unique? If you have a region with the best milk for the best cheese or whey, and you create a product that can get those unique experiences in front of consumers, your provenance can be part of your unique positioning. However, building a supply chain that wasn’t there or reconfiguring it to make it work for your product and processes is extremely difficult, to say the least. For example, sourcing from unique places and processes can create high costs for your food brand and create supply issues if not managed properly. But, because you had to build it, you have a part of your food brand that other businesses can’t compete with, at least not right away.

On our podcast this week, we interviewed Daniel Kurzrock, co-founder and Chief Grain Officer of ReGrained. ReGrained is a national brand of bars and ready-to-eat snacks made from the high-protein and high-fiber flour of “spent” grains used in the beer brewing process. They have had to develop shared-value with brewers as part of their business model to manage a more complex supply chain profitably and reliably commit to the output from the breweries. They have both a process and product that are unique in today’s marketplace as they are building these relationships and their own capacity to fully leverage them.

Note: Building a defensibly unique supply chain doesn’t mean that the food business can neglect the tried and true lessons of new product development or being responsive to new opportunities. Realistic assumptions also need to be made about whether the product resonates with consumers. These assumptions can be validated through formal or informal market research, including having a minimum viable product that is demoed and tested in a limited way with real customers.

ReGrained’s core products are bars, for now. Since the bar category is crowded and competitive, it was a learning process educate the consumer and get them to try ReGrained’s products. They are planning to generate new lines of business by making other products using their proprietary process and are starting to work as a co-packer for other brands who want to upcycle grain. In short, they are developing other opportunities to grow even as their bars are finding success in the marketplace.

Building markets and the supply chain relationships necessary to support them requires a long-term vision that aligns consumers, suppliers, funders and food companies. But, if it is properly built and capitalized, it can lead to a defensibly unique business model that allows that food company to be built to last.

And now, our roundup of the best food and beverage finance news, events and resources from around the web…

Business Model Insights

- How to forge a brand and retail partnership that will make you mainstream (New Hope Media) – “Dynamic partnerships can help brands launch new products, build successful marketing and discover more ways to have positive social and environmental change in the community and with consumers. One main challenge is to be able to continue to differentiate the products and brands by identifying white space opportunities in the market. There is a tipping point where brands hit mainstream status. Retailers have to be ready to create backfill and an ongoing pipeline. It’s important to go in with ideas that are very fleshed out and know what the retailer’s greater goals and objectives are for their brand portfolio.”

- Building A Subscription Business Model For Your Food Business (Small Food Business Podcast)

- How to build a dream-team board of directors (New Hope Media)

Raising Capital

- How do I connect with financial partners who will invest in my long-term mission? (New Hope Media) – “All money is not equal, and the benefits that come with investors’ money can vary widely. So when picking investors, first and foremost understand what expertise they bring to the table. If you are entering the food space, you shouldn’t take the first dollar from someone who makes apps for iPhones. A lot of young entrepreneurs think all they need is money and once they get it, they’ll know what to do with it. But money is secondary to expertise, which is the real catalyst for your business.”

- Finding and Approaching a VC (Entrepreneurship.org)

- 5 ways a crowdfunding campaign could help your startup (New Hope Media)

CPG/National Brands

- Distribution or Velocity (The Intertwine Group) – “How many stores, shelves, doors, are you in or on? In some form, that is the most frequently asked question of a founder of an emerging brand. However, Chasing ACV, getting sucked in by the allure of store count, can kill a brand before it ever really gets started. Unless an emerging brand has some compelling reason to be fast and first to market, focusing on building velocity is the smart strategic approach. This is because:

- It proves product/market fit. A brand learns if its value proposition resonates with its consumers.

- It allows for fast failure. A brand can experiment with placement, pricing, promotion, and gain critical insight without taking on significant risk.

- The insight gained allows a brand to optimize its go-to-market strategy setting the foundation for scale.

- It identifies the pain points and bottlenecks within a brand’s supply chain and order-to-cash process that need to be resolved prior to driving significant growth.

- It is what investors want to see. They’re interested in brands that can demonstrate traction with their consumers.”

- 4 tips from CPG executives on the future of brands (Smart Brief)

- Are you really ready to go national? (New Hope Media)

Market Trends

- How free-from foods are changing manufacturing (FoodDive) – “U.S. consumers are increasingly scanning labels to check that products do not contain certain ingredients, such as gluten, GMOs, antibiotics, pesticides and allergens. The trend is having a huge impact on how manufacturers source, prepare and package foods and beverages. Sales of these “free-from” foods are expected to grow 15%, or $1.4 billion, between 2017 and 2022 — with the U.S. as the largest global growth market. CPG companies are trying to deliver on consumer demand in this area but are struggling to find the right approach that will revive slumping sales.”

- UNFI sets net sales record in fiscal 2018 (New Hope Media)

- 9 natural products trends you’ll see on the Expo East 2018 show floor (New Hope Media)

Farming and AgTech

- HotSpots for Farm Financials (Compeer Financial) – “One of the first ratios that we look at is operating expense/revenue ratio, excluding the interest and depreciation. In other words, how much does it cost to generate a dollar’s worth of income? The second element is to look at working capital, and working capital direction. Particularly, if you do a refinance to replenish working capital, make sure that you don’t burn through that working capital too fast. A couple of other areas that we look for are: Are you building up accounts payable? Also, on the personal financials, are we seeing an increase in credit card debt? Then of course, one of the things we’re really going to have to watch for is what is your CAPEX, or Capital Replacement Strategy.”

- The Consolidation of the American Harvest (Bloomberg)

- What’s Next for Agtech? (AgFunder News)

Deals/M&A

- How brands learn from consolidation (FoodDive) – “Industry consolidation means more than getting products and facilities or access to resources and capital. Larger brands often have both statistical data and personnel expertise gained and refined during several years — if not decades — they can share with brands they acquire. This knowledge can span from end-to-end of the brand’s manufacturing processes, supply chain, marketing funnel and print and digital marketing strategies, shipping and distribution logistics, food safety and testing, ingredient sourcing, and new ingredient and manufacturing technologies developed in-house. But examining the unique expertise, energy and innovations smaller brands can also share with the companies can shed more light on industry consolidation’s benefits for both sides of the transaction.”

- Food M&A volumes sizzle in July, pushing 2018 to high (Just-Food)

- Nutrition Capital Network Deal Download: August 2018 (New Hope Media)

Industry Events

- Food Ag Ideas Week (Grow North MN) – $, 10/8 – 10/12 in the Twin Cities, MN (Multiple Venues)

- The Food Foundry Accelrator (Relish Works) – Free to apply, 10/15 Online (Accelerator in Chicago, IL)

- Food Bytes! New York Pitch Competition (Food Bytes!) – $, 10/18 in New York, NY

- Esca Bona (New Hope Media) – $, 10/22 – 10/23 in Austin, TX

- Must-have resources for scaling your omnichannel strategy (New Hope Media) – $, 10/24 Online

- Edible Startup Summit – $, 10/26 in Madison, WI

- FaBsafe Certificate: Basic Food Safety Training (FaB Wisconsin) – $, 11/14, location TBD

- Winter Nosh Live (Project Nosh) – $, 11/29 – 11/30 in Santa Monica, CA