In the fast-paced and ever changing world of food entrepreneurship, sometimes it can be difficult to fully assess and describe the business development opportunities that should be taken advantage of. Customers need to be served, vendors need to be paid, and it is difficult to find the time to focus on developing and growing the business, refining the business model, and positioning the business for the future. Luckily, there are some tools that can help visualize what is going on in the business in a way that helps make informed decisions about where the business should be headed.

Business Model Canvas

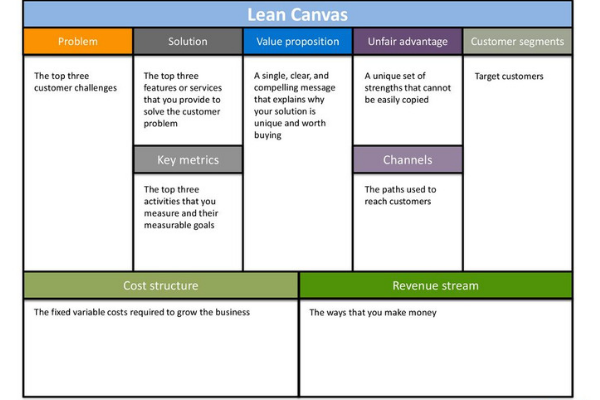

The Lean Business Model Canvas was developed as a tool to make the process of new product and new business development more streamlined. It does this by forcing entrepreneurs to quickly iterate their business via a non-linear process that documents the business model (i.e. the interrelated set of things that ensure the business makes money) before committing to or writing down a larger plan. This allows the entrepreneur to iterate and test their business model (by trying things and researching things) that they can then revisit by looking at their most recent canvas.

Notice that the Unique Value Proposition is in the middle (see above), since being defensibly unique is central to the business and business model being viable. Often entrepreneurs change what they thought were essential elements of their business (like what their value proposition is and who it is for) after testing it with real customers in real situations, and this necessitates changing other things on the canvas as well. Seeing how changing one aspect of the business necessitates changing another aspect is an invaluable part of using the canvas.

Once what makes their model “work” becomes clearer after these iterations, the canvas can serve as a basis for a larger plan. The canvas gives food entrepreneurs the freedom to experiment while documenting what are the most important things to focus on to make their business viable

Competitor Matrix

When food entrepreneurs are summarizing their business models in a slide deck for presentation to lenders and investors, the competitor matrix is one of the slides that are required to make a successful pitch. This tool places the food business in the context of the competition (specifically, businesses with competing product categories going after the same target customer), allowing lenders/investors (and the entrepreneur) to see where they fit against the facets of the food business that make it defensibly unique in the marketplace.

The facets against which food entrepreneurs should compare themselves to the competition vary from business to business. These facets could include basics about the product and customer experience like price, quality or service, but can also include less tangible things like trust. And, it can also include things related to the defensibly uniqueness of the business model but that might not matter to the customer. For example, any food business with a proprietary process or dedicated manufacturing facility might be able to list those facets as points of differentiation if it gives them a competitive edge over their competition.

The point of this exercise isn’t to show how your food business is superior to all competition on all of the facets. Realistically, some of your competitors can compete with you on at least one of those facets of your business. But, a good matrix should show that the business model and product set provide something unique in the marketplace through 3-5 points of differentiation that no one competitor can match fully.

Sales Forecast By Channel

Whenever we help food businesses develop their proforma (forward looking) financial statements, we often work with them to develop a sales forecast by channel, usually monthly for at least one year and then yearly after that. We help them break this part of their financial statements (the sales lines on the Income Statement) into its own spreadsheet to make things easier to digest. And, our template helps them note when new key customers that will greatly expand distribution are coming into the business, allowing the food entrepreneur to see which channels will bring in the most sales. Since this is done in a spreadsheet tool, it can be visualized as a bar chart!

As this tool is iterated and revisited by the business as they see what traction they are able to get, food business owners can refine their business model and clearly communicate future growth targets to employees and lenders/investors. And, it helps clarify where the business needs to focus (in terms of marketing spend and cash flow management) to support bringing in new channels of distribution.

There Is No Perfect Tool

There are no shortage of tools and templates that help provide clarity and bring order out of seeming chaos for food businesses. However, these tools are no substitute for strong accounting and financial statements to manage food businesses. But, the business model canvas, the competitor matrix and sales forecast by channel can help visualize key aspects of food businesses as they seek to grow and get profitable.

And now, our roundup of the best food and beverage finance news, events and resources from around the web…

Business Model Insights

- The Rise of the Virtual Restaurant (New York Times) – “No longer must restaurateurs rent space for a dining room. All they need is a kitchen — or even just part of one. Then they can hang a shingle inside a meal-delivery app and market their food to the app’s customers, without the hassle and expense of hiring waiters or paying for furniture and tablecloths. Diners who order from the apps may have no idea that the restaurant doesn’t physically exist. The shift has popularized two types of digital culinary establishments. One is ‘virtual restaurants,’ which are attached to real-life restaurants like Mr. Lopez’s Top Round but make different cuisines specifically for the delivery apps. The other is ‘ghost kitchens,’ which have no retail presence and essentially serve as a meal preparation hub for delivery orders.”

- Meet Your Consumers Where They Are (Intertwine Group)

- Founder of Creation Nation shares tips for finding a co-packer (Food Navigator)

Raising Capital

Raising Capital

- What Your Food Business Financial Statements Are Telling You (Edible-Alpha®) – “If you don’t understand what your financial statements are saying about your business, you will pay the cost in unrecognized accounting problems, lost opportunities to make the company more profitable, and an inability to raise capital. This course puts particular emphasis on common problems with food business financial statements and how funders of food and beverage businesses, like banks and investors, look at your financial statements to evaluate your business when making the decision to fund you.”

- How to know when you should get outside funding (New Hope Network)

- Which crowdfunding platform is right for your brand? (New Hope Network)

CPG/National Brands

- How CPG companies use price increases to bolster their bottom lines and reputations (Food Dive) – “More food and beverage companies are using price increases to boost bottom lines as they face higher costs, more competition and changing consumer demands. Last year, several big food companies announced they were increasing prices in 2019. For many, those hikes have been successful. U.S. food prices increased 2.4% during the 52 weeks ending July 20, compared to 1.4% the previous year, according to Nielsen. The frozen and deli departments featured similar price increases, with 1.9% and 1.5% price hikes during this timeframe, respectively. This is compared to 1.7% and 1% price increases during the year before.”

- Who’s NOT Selling My Products? or How to Identify Distribution Voids (CPG Data Insights)

- Why it Takes so Long to get on the Shelf (Food Biz Whiz Podcast)

Market Trends

- Report: Most consumers distrust meat and dairy companies/producers (Store Brands) – “According to the The Hartman Group’s Food & Technology 2019: From Plant-based to Lab-grown report, almost all consumers — whether they purchase plant-based foods or not — have some level of distrust in meat and dairy companies/producers. The report found that milk, meat and dairy alternatives are growing swiftly, while meat is growing slowly and milk is in decline. Over half of consumers (51%) have purchased plant-based milk, dairy, or meat in the last three months. These products are no longer a niche lifestyle choice but a prominent feature of mainstream food culture, the report stated.”

- 5 Top Consumer Spending Trends in Grocery (Progressive Grocer)

- What will drive repeat purchase behavior of plant-based meat alternatives? (Food Navigator)

Farming and AgTech

Farming and AgTech

- Farmers Prevented from Planting Crops on More than 19 Million Acres (USDA) – “Agricultural producers reported they were not able to plant crops on more than 19.4 million acres in 2019, according to a new report released by the U.S. Department of Agriculture (USDA). This marks the most prevented plant acres reported since USDA’s Farm Service Agency (FSA) began releasing the report in 2007 and 17.49 million acres more than reported at this time last year. Of those prevented plant acres, more than 73 percent were in 12 Midwestern states, where heavy rainfall and flooding this year has prevented many producers from planting mostly corn, soybeans and wheat.”

- Growing Regenerative Ag One Investment at a Time (Regenerative Food Systems Investment Forum)

- Understanding Farm Financials: Cash Flow Essentials (Compeer Financial)

Deals/M&A

Deals/M&A

- Venture capitalists feast on food in search of big profits (Food Dive) – “Just a decade ago, investors clamored for pieces of the newest technology startups. Today, a growing number of them are looking for riches by acquiring stakes in food companies working on trendy products popular with consumers. The path that prompted investors to shift their money from technology to food was built on failure. Food, it turns out, has always been valuable. People have to eat and tend to choose food they love — which can make an investment in the space a lucrative one.”

- Nutrition Capital Network Deal Download: August 2019 (Nutrition Capital Network)

- Atkins owner to acquire protein-food maker Quest for $1B (Food Dive)

Industry Events

Industry Events

- The Farmer’s Edge (Julia Shanks Food Consulting and Kitchen Table Consultants) – $, classes begin 9/10 Online

- Expo East 2019 (New Hope Network) – $, 9/11 – 9/14 in Baltimore, MD

- Guiding Wisconsin Farmers to Legal Resilience (Farm Commons) – Free, 9/13 in Madison, WI

- Regenerative AgTech (Food+Tech Connect) – $, 9/19 in New York, NY

- The Basics: The Business of Specialty Food (Specialty Food Association) – $, 9/24 in Philadelphia, PA

- Food Culture Forecast (Hartman Group) – $, 9/29 in Chicago, IL

- 2020 Farm Bureau Ag Innovation Challenge (Farm Bureau) – Free to apply, 9/30 Online

- Regenerative Food Systems Investment Forum – $, 9/30 – 10/1 in Oakland, CA

- Good Food Accelerator (FamilyFarmed) – Free to apply, applications due 10/1 Online

- Food and Ag Ideas Week (Grow North MN) – $, 10/10 – 10/15 in Minneapolis, MN

- National Farm Viability Conference 2019 (Multiple Hosts) – $, 10/22 – 10/24 in Redwing, MN

- Regenerative Earth Summit (At The Epicenter) – $, 10/29 – 10/30 in Boulder, CO

- Annual Farmer Cooperatives Conference (University of Wisconsin Center For Cooperatives) – $, 11/6 – 11/8 in Minneapolis, MN

- Good Food Financing and Innovation Conference (FamilyFarmed) – $, 11/6 in Chicago, IL

- Business Tax Basics (UW-Madison SBDC) – $, 11/19 in Madison, WI

- National Good Food Network Conference (2020) (Wallace Center) – $, 3/10 – 3/13 in New Orleans, LA